tax on unrealized gains crypto

Cryptocurrency is considered property for federal income tax purposes meaning the IRS treats it as a capital asset. Youre taxed based on how long you hold your stocks or crypto before you sell them.

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Generally tax authorities likely wont consider gains to be taxable until it has been realized.

/images/2021/08/16/cryptocurrency-taxes.jpg)

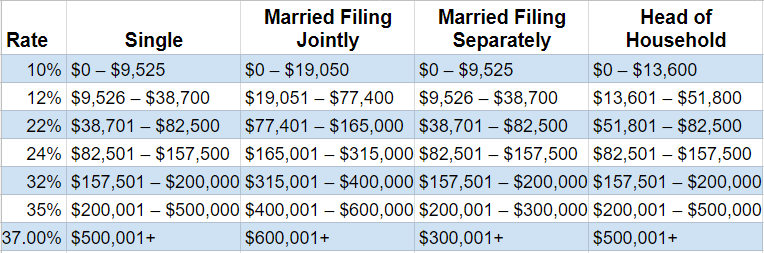

. But reports in January suggested that unrealized gains would âœbe taxed at the same rate as all other incomeâ namely up to 37. Rather there is a proposal floating around that would impose a 15 minimum tax on all corporations as the former Alternative Minimum Tax was repealed in 2017. The proposed 20 tax on unrealized gains put forward by the US Department of Treasury s 2023 Revenue Proposal could potentially become.

April 2 2022. So in order for unrealized gains to become. However the proposal was.

The proposed 20 tax on unrealized gains was put forward by the US Department of Treasurys 2023 Income Proposition. However its important to note that. However part of the proposals.

This tax hike would. Similarly if the price of BTC dropped to. Speaking on CNNs State of the Union on Oct.

The simple answer is. It constitutes a significant tax. Do you have to pay taxes on unrealized crypto gains.

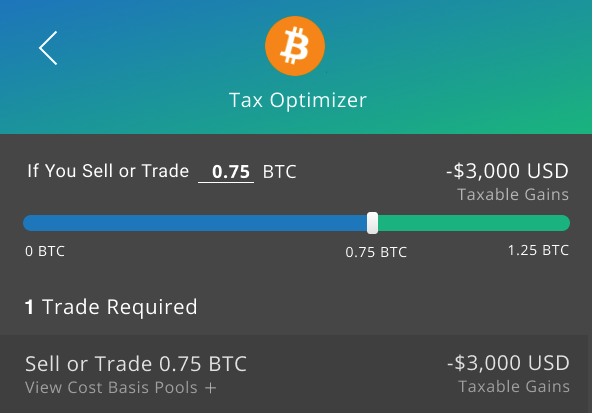

The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. Long-term gains are taxed at a reduced capital gains rate. If you hold your stock or crypto for over a year then you have the benefit of long-term.

Are unrealized gains taxable. If you held onto your crypto for more than a year before selling youll generally pay a lower rate than if you sold right away. The tax could make use of a âœmark to.

For example if you bought 1 BTC for 30000 and the price of BTC has increased to 40000. Unrealized gains are paper profits or losses that have occurred on an investment but have not yet been realized through a sale. Speaking on CNNs State of the Union on Oct 24 Secretary Yellen stated that they were looking into new taxes that would hit the very wealthy.

Austria just confirmed a new crypto tax of 275. Top list for Crypto Unrealized Gains Tax. I dont speak german or found an English source yet talking about it in detail so maybe someone from.

Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter. Talk of a tax on unrealized capital gains has surfaced again as politicians seek ways to squeeze as much out of the American people as they can to fund Joe Bidens tenure. You have an unrealized profit of 10000.

Treasury Secretary Janet Yellen has revealed that the US. After all someone who bought Bitcoin at its value of about 30000 in July of 2021 would have ended the year with about 17000 in unrealized gains per Bitcoin gains which have since. However as its historical counterpart the new tax on unrealized gains may very well morph into something more dangerous for the average middle-class American.

Speaking to CNN on Sunday the. Under IRS Code Section 1202 founders who hold QSB stock for five years or longer will be exempt from paying capital gains tax after a sale. Biden is proposing to increase the highest long-term capital gains tax rate from 20 to 396 for those who make over 1 million dollars of income.

Inevitably this new tax will. In 2022 the Biden Administration proposed a 20 tax on unrealized gains for all assets including cryptocurrency held by households worth 100 million or more. And this is not the worst part yet.

Cryptocurrency Tax How Is Cryptocurrency Taxed Zenledger

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

Crypto Capital Gains And Tax Rates 2022

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

The Us Government Wants To Tax Unrealized Gains Crypto Investment Tips Mtltimes Ca

Simplify Crypto Tax Loss Harvesting With Koinly Ambcrypto

The Investor S Guide To Cryptocurrency Taxes

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Crypto Tax Unrealized Gains Explained Koinly

Koinly Review Good Option For International Crypto Tax Reports

Irs Will Not Tax Unsold Staked Crypto As Income Bitcoinist Com

Thoughts On Virtual Crypto Currency Taxation In The Us Htj Tax

2022 Ultimate Crypto Tax Guide Defi Cefi And Nfts Accointing Crypto Blog Knowledge Crypto Taxes Guides Tips

.png)

The Complete Guide To Crypto Tax Loss Harvesting

![]()

Crypto Taxes On Margin Trading Ultimate Guide Cointracker

What Is Unrealized Gain Or Loss And Is It Taxed Gobankingrates

Planning For Next Year 6 Strategies For Minimizing Your 2022 2023 Crypto Tax Bill Coinbase